There are many types of Power of Attorney that an individual can take out. This depends on what you, as the principal, wish to delegate to your appointed agent.

In all cases, Power of Attorney forms allow individuals to carefully plan for their future healthcare or financial needs. They enable the principal to have peace of mind that all their affairs will be managed responsibly if they are unable to give their agreement in person.

Fortunately, In the United States, it is a simple process to sign a POA and assign an agent thanks to the Uniform Power of Attorney Act [2].

The most common POAs are listed below.

Durable (Financial) Power of Attorney

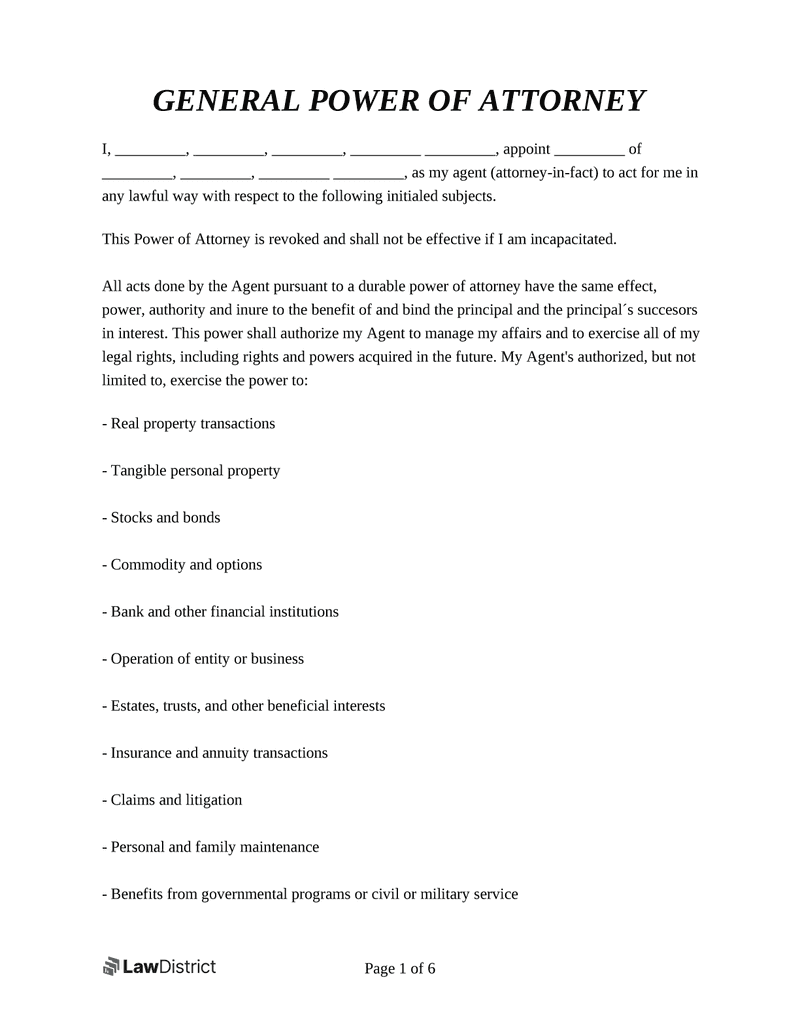

A Durable (Financial) Power of Attorney, permits your appointed agent to make legal and business decisions for you if you become disabled, incapacitated, or unable to handle these matters on your own.

Some of these decisions include:

- Handling bank accounts

- Settling claims

- Managing assets

- Filing taxes

- Purchasing life insurance

- Making gifts

- Managing real estate holdings

- Buying and selling stocks and bonds

- Signing contracts

Meanwhile “nondurable” powers of attorneys are automatically terminated if the individual who made them loses mental capacity. A Durable Power of Attorney remains effective until revocation of Power of Attorney is carried out or the principal dies.

Medical Power of Attorney

Medical POAs allow your agent to make healthcare decisions for you if you are incapacitated or unconscious.

The agent you choose can then carry out decisions that have to do with surgery or end-of-life care.

This allows your wishes regarding your treatment to be respected even if you cannot give your consent due to an accident, injury, or illness.

The person you name to take care of these decisions on your behalf is known as your healthcare agent or proxy.

Child Power of Attorney

A POA form exists for minors as well, and it is used in the event a parent or parents must grant temporary parental authority to another individual.

This usually takes place when a minor’s parent(s) or legal guardian cannot look after their child for whatever reason.

A Child Power of Attorney is a less permanent form of a guardianship as it is typically only given for a period of 6 to 12 months.

If an agent is given this authority they can make health care or educational decisions for the minor. They can also accompany the child or children on any international trips.

Springing Power of Attorney

A Springing Power of Attorney gives an agent the power to make financial or medical decisions on your behalf, such as those entrusted by durable and general POAs. However, a Springing POA only comes into effect when certain conditions are met.

Although this type of document can entrust the same responsibilities given by other POAs, it is conditional, and it remains inactive until the principal becomes incapacitated.

Special Power of Attorney

A Special Power of Attorney allows you to appoint an individual to manage a one-off transaction or financial action. With a Special POA, your attorney-in-fact will only be able to only manage specific affairs for you for a limited duration.